Heloc affordability calculator

Send us a secure email with a question or to get account information. Input the annual interest rate you are charged on your HELOC.

3

HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments.

. Repairs additions vehicle purchase. Whether you need funds for a home improvement project or a low-interest loan for debt consolidation borrowing against your home equity with a home equity line of credit HELOC can get you the. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

When it comes to calculating affordability your income debts and down payment are primary factors. Thats because the amount of the HELOC plus the amount you owe on your mortgage can be no higher than 200000. Consolidating high-interest credit card balances other debts home improvement.

Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying.

For example say you get a HELOC with an 80 loan-to-value LTV ratio. Collect the required information. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV.

Factors that impact affordability. For security reasons youll need to sign in to Chase Online SM and use our Secure Message Center to send us an email. While your personal savings goals or spending habits can impact your.

Generally speaking it is easier to qualify for a HELOC when you have a large amount of home equity and a low loan-to-value ratio. Some of the most common uses are. While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest.

Collect the required information. Lenders look at two ratios when determining how much mortgage you qualify for. Choose the Customer Center tab then choose Send a.

This will be the only land contract calculator that you will ever need whether you want to calculate payments for residential or. 15000 to 750000 up to 1 million for properties in California. Less common when auto manufacturers offer low loan rates but when auto rates are higher than equity rates.

What is the difference between getting a HELOC and a second mortgage. Compare the latest rates loans payments and fees for heloc and home equity loans. Gross Debt Service ratio GDS total monthly housing costs shouldnt be more than 39 of your gross household income Total Debt Service ratio TDS total debt load shouldnt be more than 44 of your gross household income In addition the federal stress test may impact the mortgage.

Weighing HELOC Costs vs. Make sure you understand your options and read the fine print before agreeing to lock in on a fixed rate HELOC. 300000 X 80 240000.

A home equity loan make sure you understand the total package of fees that you would have to pay. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. A HELOC on the other hand gives you the flexibility to borrow and pay off the credit whenever you want.

But first youll need to take some preliminary steps to ensure the calculator yields accurate results. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. Home Equity Loan Costs.

240000 150000 90000. If you have questions or concerns about your Home Equity account you can reach us here. Current Chase home equity customers.

To figure out how much your credit limit would be on this HELOC multiply your homes value by 80 and subtract your current balance. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25. Before you decide on a HELOC vs.

In this scenario you might be able to get a home equity line of credit of up to 50000. Calculate Your HELOC in Six Easy Steps. This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance.

Our home affordability calculator weighs several factors to figure out how much home you can afford. Input your remaining HELOC balance. Homeowners tap home equity for a wide variety of reasons.

Input your net after tax income and the calculator will display rentals up to 40 of your estimated gross income. Your home is worth 300000 and you currently owe 150000. Common Home Equity Loan Uses.

Figure out your desired monthly payment.

How To Use A Rent Vs Buy Calculator Forbes Advisor

Downloadable Free Mortgage Calculator Tool

Can I Afford To Buy A Home Mortgage Affordability Calculator

Mortgage Payment Rate Calculators True North Mortgage

1

Heloc Calculator Calculate Available Home Equity Wowa Ca

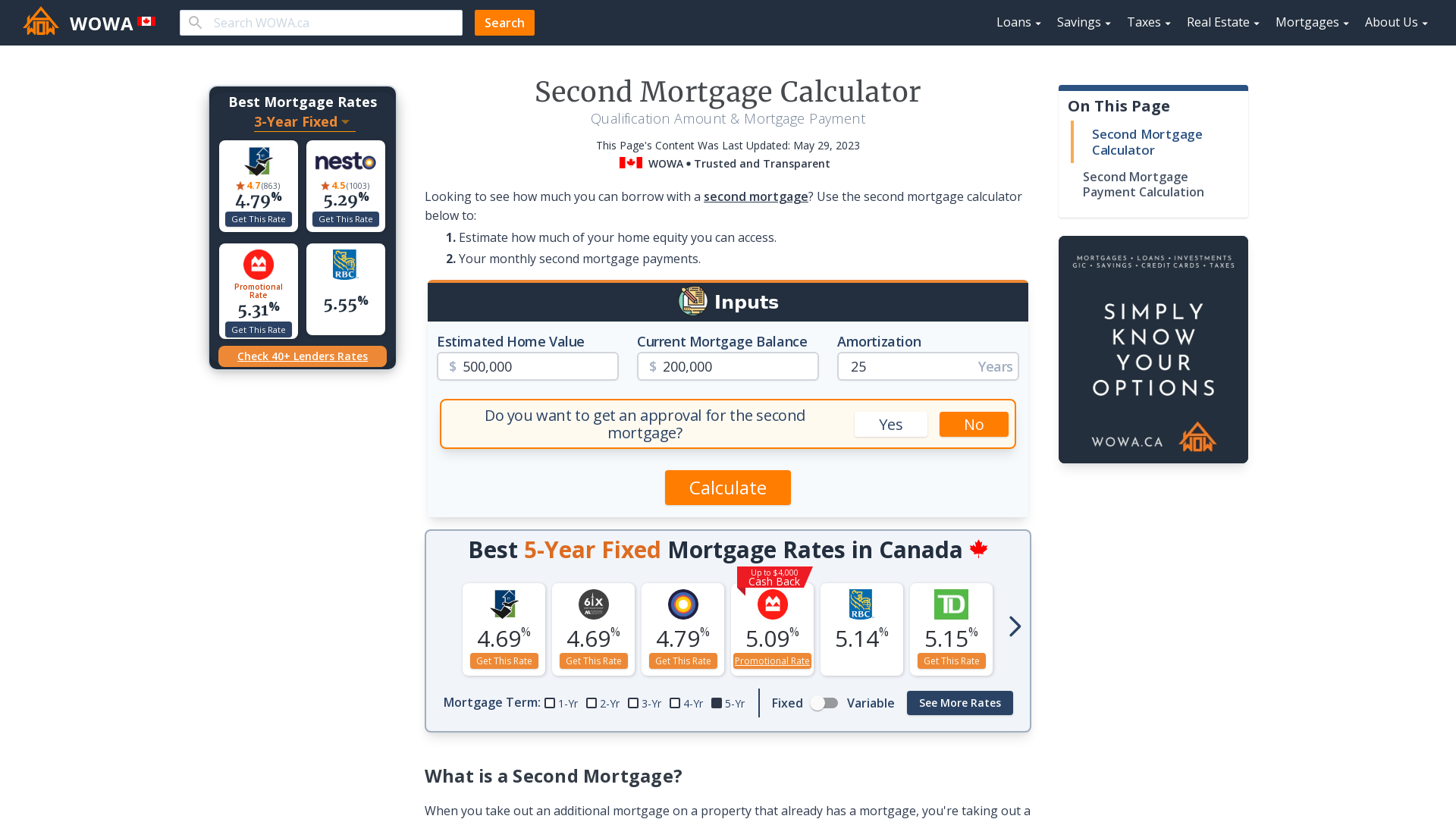

Second Mortgage Calculator Qualification Payment Wowa Ca

1

Heloc Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Mortgage Payment Rate Calculators True North Mortgage

30 Year Fixed Mortgage Calculator Forbes Advisor

1

Mortgage Affordability Calculator 2022

Planning To Buy A House Spreadsheet Budgeting Worksheets Spreadsheet Business Buying First Home

Home Equity Line Of Credit Qualification Calculator

How To Calculate Equity In Your Home Nextadvisor With Time